Moving to Australia under the SIV

Call Australia your home

Now that you have decided to apply for residency in Australia under the Significant Investor Visa (SIV) you are working through the many considerations you need to take into account before boarding that flight to your new home.

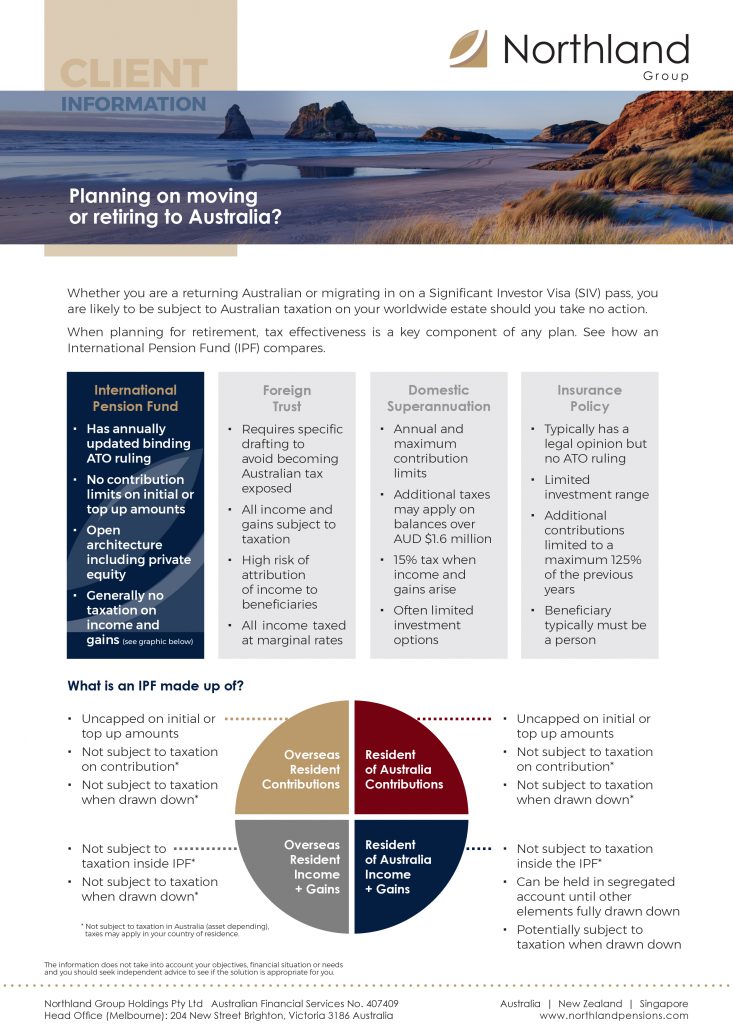

One of the first items that you will note about your future home is that Australia applies its’ personal income and capital gains tax regime on your worldwide estate meaning that all of your accumulated assets and investments around the world are exposed, however, Australia does incentivise its’ residents to provide for their own retirement and by structuring your estate efficiently you can put yourself and your family in the best position.

For over 25 years we at Northland Group have been assisting clients just like you to identify and take the right next step for them as they set up home in Australia.

Northland Group has been assisting clients like you structure for their move to Australia for three decades.

Having lived and worked overseas you have likely been based in countries that structure their superannuation, or pensions, in different ways to Australia’s domestic system which created challenges for those moving to Australia to efficiently benefit from the fruits of their overseas labours.

Recognising the issues inherent with treating and taxing foreign countries versions of superannuation/pension as a foreign trust the foreign superannuation fund concept was introduced. Under this a qualifying foreign superannuation will be treated distinctly from and more favourably than a foreign trust.

Foreign Superannuation Fund Structure

The treatment of the foreign superannuation fund when you drawdown on it in Australia is split into three sections:

- The contributions that you make to fund

- The income and gains from the funds assets whilst you are non-resident of Australia;

- The income and gains from the funds assets whilst you a resident of Australia (also referred to as Applicable Fund Earnings or AFE)

In Australia when drawing down neither the contributions nor the foreign income and gains are subject to personal income tax whereas applicable fund earnings are. Upon moving to Australia we assist our clients to segregate their funds so that their contributions and foreign income and gains are accounted for separately to their applicable fund earnings so that only once the former is fully drawn down do they move on to drawing down their AFE and being subject to personal income tax. Additionally assets can be segregated into separate sub-funds with different investment strategies allowing for further planning opportunities which you should discuss with your advisors.

Elements of a Foreign Superannuation Fund

A foreign superannuation fund is an open architecture solution that can hold:

Investment Accounts or Portfolios

Insurance Policies

Private Equity

Operating Company Shares

Listed Equities

Commercial and Investment Residential Property

Collectibles

Other Assets

Note: Private use residential property in Australia and personal use assets cannot be held under your foreign superannuation fund.

For those moving to Australia the foreign superannuation fund is a flexible and efficient planning tool to meet long term needs. Northland Group representatives are happy to discuss with you and your advisors your circumstances to evaluate whether this might be the right next step for you and your family in your journey to your new home.

Download the Northland Group client brochure below:

Please enter your email to access to the following download: